COLUMBUS INDEPENDENT SCHOOL DISTRICT

Upcoming election takes place May 5

COLUMBUS — Much of the discussion surrounding the upcoming May 5 elections involves the Columbus Independent School District as the ballot will feature a School Board election and a few propositions for bonds to earn the district an influx of funds.

The proposed bonds have dominated the discussion as advocacy groups such as Champion for Columbus Children and various Parent Teacher Associations in the district. They are split into two propositions on the ballot.

The first is Prop A, a vote to receive $8,440,000 of bonds for the construction of new classrooms and renovation of existing classrooms at Columbus Elementary School.

Prop B is a similar proposition as the district hopes to garner $5,320,000 in bonds for the construction of a new Career Technology Education building.

Both propositions include a clause that states the bonds will result in a property tax increase as both state a tax equal to the principal and interest of the bonds will be added to school district taxes. However, according to presentations by school officials, the tax rate will decrease with either or both propositions passing.

The projects proposed in Prop A will create a new fifth-grade wing with additional classrooms and a science lab. It will also fund the renovation of existing classrooms and functions such as electrical and plumbing. The plan also includes adjustments to the parking lot.

“We are currently at capacity with enrollment, and we need mroe space to adequately support our students,” Columbus Elementary PTO member Cece Davis said, “Also, major repairs are necessary to plumbing and electrical in the original school buidling.”

Prop B relates to the construction of a new building for vocation- al trades in a partnership with the high school. It also includes the renovation of the existing career and technology building and the agriculture building. The new CTE building will feature programs from a variety of studies between the arts, STEM and agriculture.

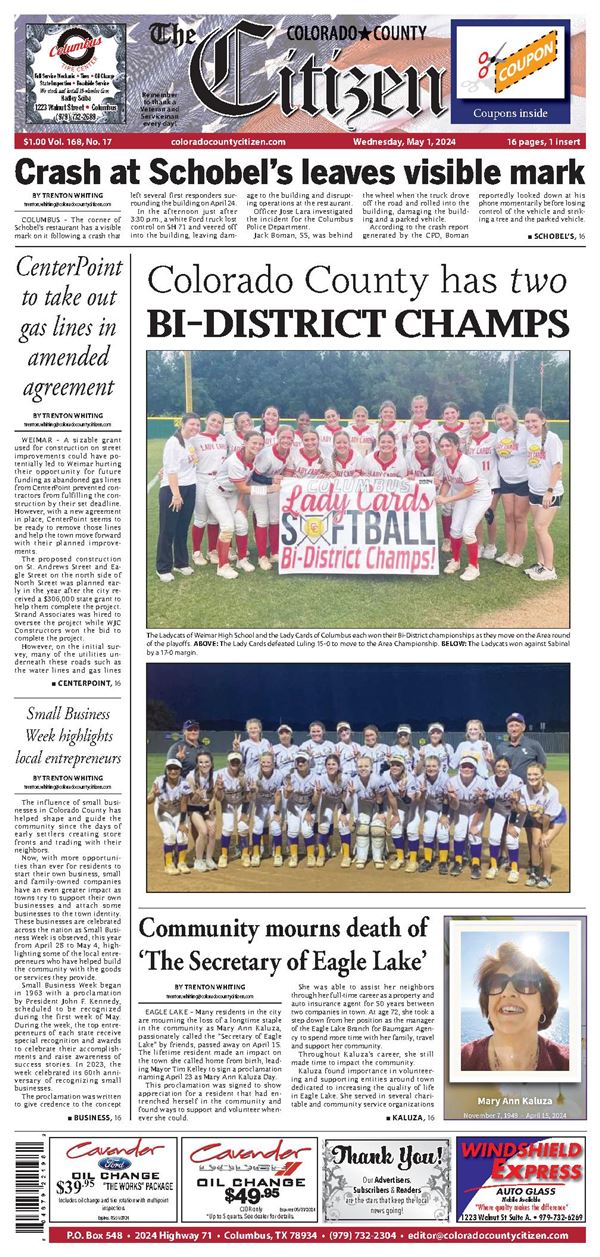

Pictured are Reese Kulhanek, Briley Zapalac and Amelia Zapalac.

Issues regarding bonds have been a difficult selling point for CISD in the past.

During the 2022 election season, two separate bonds on the ballot were rejected by voters as a $90 million bond, also for a new CTE building, was voted down in May followed by a failed November tax increase to improve campus safety and increase teacher salary.

The main difficulty for voters historically has been their concerns with an increased tax rate to fund projects with a high price point.

In a town hall with CHS Principal Diana Sarao, she explained that the current property tax rate of $0.88 per $100. The rate is a combination of taxes sent to interest on bonds as well as taxes for day-today maintenance.

Sarao explained that if both are passed, the amount of taxes dedicated to interest and principal on bonds will decrease, resulting in a rate of $0.83. If only Prop A passes, the tax rate would drop to $0.81 and if only Prop B is passes, the rate would drop to $0.79.

The decrease is due to prior bonds being refinanced into the proposed bonds with a lower interest “We are prepaying old debt, meaning we’re paying extra on current bond notes,” Principal Sarao said during the town hall.

School district tax rates have decreased steadily since 2014 and currently stands at its lowest mark during that stretch, as well as its first year under $1.

There are several opportunities for Columbus residents to learn more about the proposed bonds from advocates as well as concerned residents.

Nesbit Memorial Library will host a town hall meeting on Thursday, April 18 at 6:30 p.m. to 8:30 p.m. A meet and greet for county candidates will be included with the discussion surrounding the bond election.

Questions for the town hall must be submitted by noon on Wednesday, April 17 to Brenda Buehler at lazyb2013@ gmail.com.

.jpg)